Tomorrow, the Federal Reserve Board is set to announce its latest decision regarding interest rates. Will it be yet another 75-basis point increase, as many expect, or will the Fed indeed “go big” with a 100-basis point hike as some are predicting?

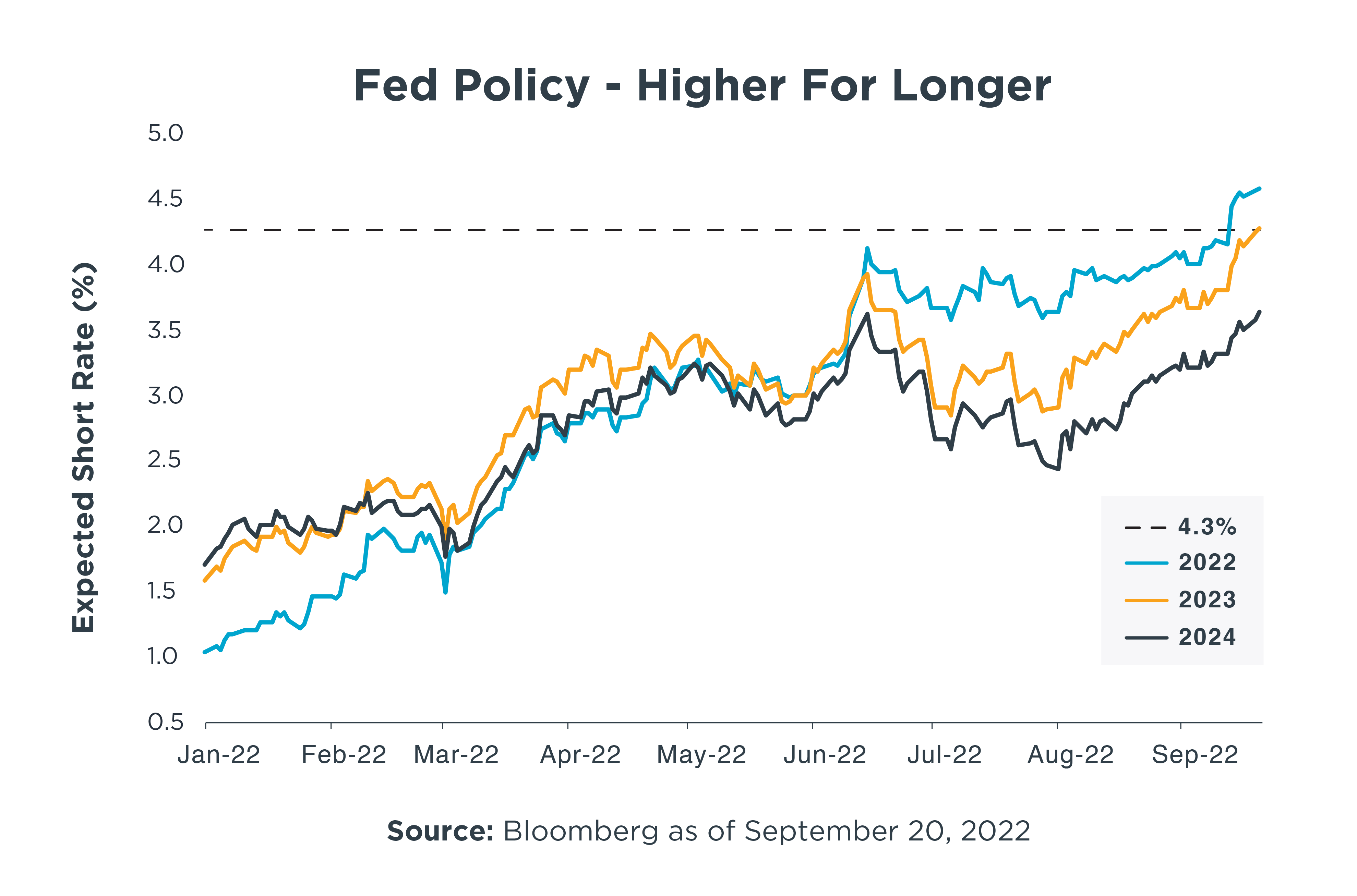

While the answer to that question will be important in the short-term, our eyes are also on where the Fed Funds Rate will likely be at the end of 2023. This, of course, remains a moving target—but as shown by the orange line in the chart, the market currently expects the Fed Funds Rate to sit at around 4.3% at the end of next year. That’s up sharply from an expectation of approximately 1.6% back in January.

That target has risen steadily over the course of 2022 as investors have (somewhat slowly and unwillingly) come to grips with the fact that the Fed fully intends to remain aggressive in its fight against inflation. That realization was further solidified by last week’s August inflation (CPI) report, which showed an unexpectedly sharp rise in core prices. In addition, the gray line in the chart indicates that the Fed is expected to keep rates relatively high through 2024 rather than pivoting and starting to bring borrowing costs down.

This rising trend in interest rates is what we have been calling “higher for longer” for some time now. Tomorrow’s Fed’s statement, and comments from Chairman Powell, will likely emphasize that message exclusively—effectively ignoring growth concerns as the Fed stays laser-focused on inflation.

For investors, this will likely mean continued volatility in asset markets. Since equity market valuations are determined in large part by short-term interest rates—as noted back in August—Fed-driven volatility in such rates likely need to settle down before stock market volatility can do the same. Given these conditions, we plan to maintain our defensive positioning for the foreseeable future while looking for potential opportunities that market volatility may uncover.

This commentary is written by Horizon Investments’ asset management team.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2022 Horizon Investments LLC