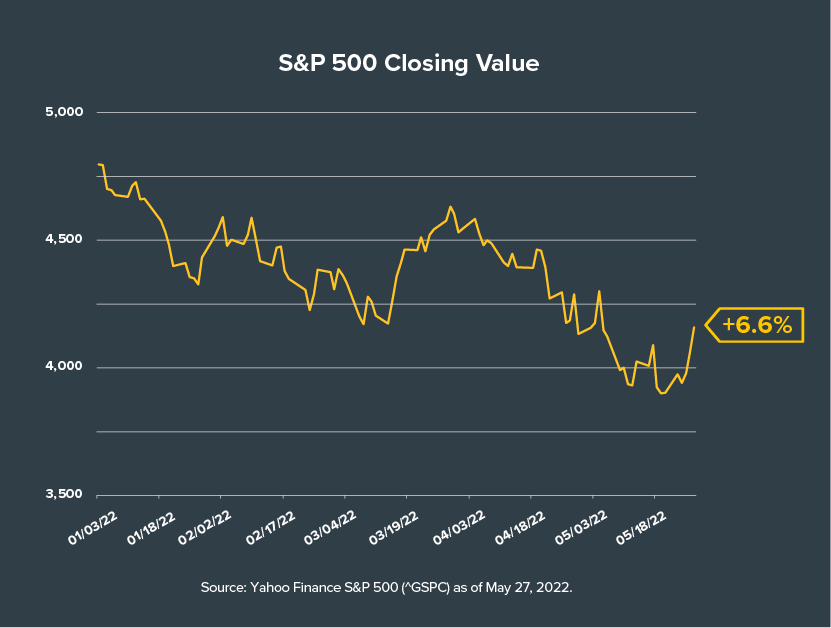

Equity markets sent investors smiling into the Memorial Day weekend, thanks to the biggest weekly gains for the S&P 500 (+6.6%) and the Dow Jones Industrial Average (+6.2%) since 2020. The Nasdaq topped both, soaring 6.8% for the week.

Amazingly, much of the credit goes to the Federal Reserve Board—which lately has been far more investors’ tormentor than their cheerleader. But the minutes from the Fed’s last meeting, released last Friday, showed a less-hawkish-than expected Fed that could be looking to “front load” interest rate hikes to tame inflation faster.

Amazingly, much of the credit goes to the Federal Reserve Board—which lately has been far more investors’ tormentor than their cheerleader. But the minutes from the Fed’s last meeting, released last Friday, showed a less-hawkish-than expected Fed that could be looking to “front load” interest rate hikes to tame inflation faster.

This prospect of a friendlier Fed helped turbocharge the equity markets’ rally, particularly the beaten-down consumer discretionary sector. The obvious question: Will it last–or are we looking at a relief rally before markets head south again?

For clues, consider that today’s financial conditions are hovering around their historical average. In other words, while they’ve tightened considerably from the worst of the pandemic, they’re not actually tight yet. And the Fed has made it clear that it is laser-focused on taking decisive steps to achieve tighter financial conditions and get inflation under control.

At Horizon, we believe that until the Fed shifts its attention away from beating inflation and back toward growth and employment, the medium-term risk for equities skews to the downside—even as we may see short-lived rallies here and there.

This commentary is written by Horizon Investments asset management team.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. It is not possible to invest directly in an index.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2022 Horizon Investments LLC