Surging oil prices caused by the Russia-Ukraine conflict not only threaten to increase inflationary pressures. The surge could cause a stagnant U.S. economy as shoppers devote more money to rising energy bills and less money to everything else – the very definition of ‘’stagflation.’’

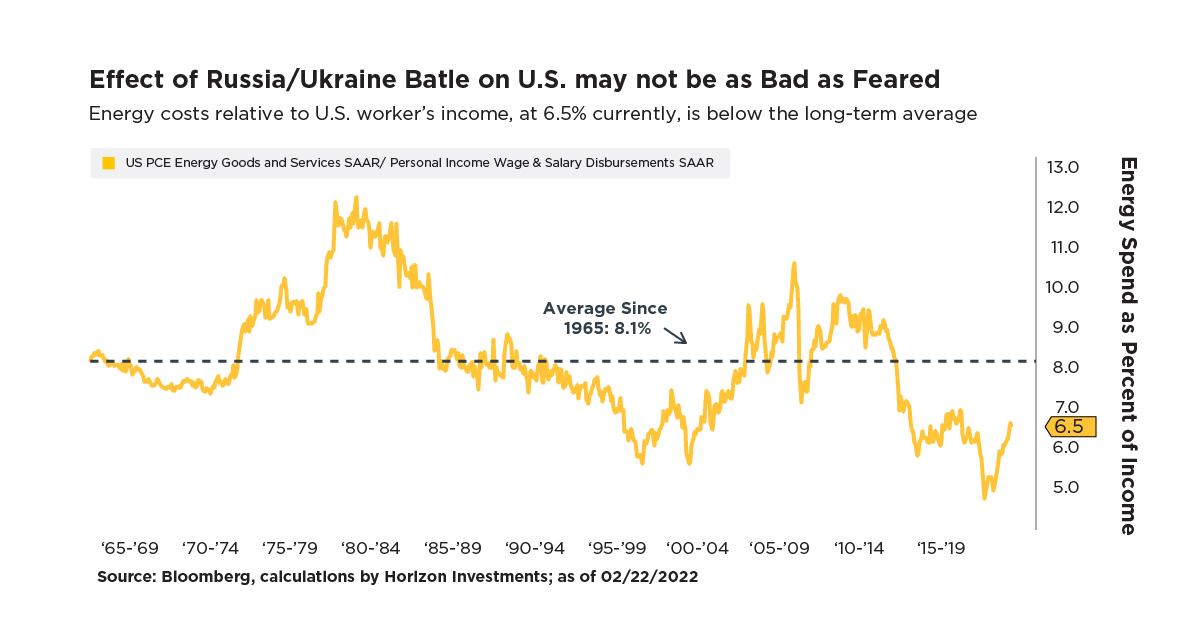

While ‘’stagflation’’ may have been a reasonable argument in the past, we think that current economic circumstances make it less likely. Take, for example, the shrinking chunk of the American household budget that’s spent on energy. At 6.5% of income currently, energy costs are below the five-decade average of 8.1%, and well below the 10%+ level of 2008 when U.S. benchmark oil prices leaped to $140 a barrel.

Higher oil and gasoline prices are painful, but we think the burden shouldn’t be enough on its own to take a big bite out of this year’s expected U.S. GDP growth of 3.7%.1

Household balance sheets are in better shape to weather a jump in oil costs after many Americans

used pandemic stimulus payments to pay down debt. Household debt as a percentage of personal income was 85% as of Q3 2021, the lowest in twenty years (excluding pandemic distortions), according to Bloomberg data. Meanwhile, low-skill wages grew by 4.2% year-on-year in January, the largest increase in 19 years, according to the Federal Reserve Bank of Atlanta’s Wage Tracker data.2 Pay for high-skilled workers was also rising, according to the Atlanta Fed, with January’s 3.9% year over year bump up being the biggest in 12 years. Overall, Americans are in good financial health and should be able to weather a temporary jump in energy costs due to the Russia-Ukraine conflict.

Also keep in mind that an energy shock is harder to create today compared to the 1970s. Worldwide, there’s growing efficiency in the use of oil to generate economic growth. The so-called energy intensity of global GDP is half of what it was fifty years ago. It currently takes 0.43 of a barrel of oil to produce $1,000 of GDP versus nearly 1.0 barrel of oil in 1973, according to Columbia University’s Center on Global Energy Policy.3

More efficient use of energy isn’t a magic bullet, of course. Stagflation is possible should oil prices set new highs during the conflict. However, we think the odds of a repeat of the 1970s and ‘80s is low. The American economy is far more services oriented than 50 years ago, household balance sheets are stronger, and the country is now a net exporter of energy versus being a major importer in ‘70s.

While the underlying economic supports are strong, the markets still have to wrestle with many unanswered questions, which suggests to us that volatility will remain elevated. The uncertainty around Ukraine only compounds the bigger macro questions that were already moving markets this year. Questions such as how quickly will the Federal Reserve raise interest rates, and whether the Fed would deliberately cause a recession if that’s what’s needed to defeat inflation? Those questions are no less important as the Ukraine conflict continues.

For goals-based planning and investing, roller-coaster markets may drive a desire to preserve portfolio values amid heightened concern about a downturn. Horizon Investments offers protection stage investors the Risk Assist® strategy, which is designed to help maintain accumulated wealth for funding future goals.

Further reading:

Q4 Focus Magazine: The Good, The Bad and The Ugly of Inflation

2022 Outlook: The Next Unprecedented Year

Any Retirement Salvation? Puny Yields in a Rate-Hiking Cycle

Disappearing Foreclosures Add to Housing Inflation Pressures

Is Inflation Pressure Easing? Factory Input Costs Tumble Again

Abnormally Low Rates Remain Even If Fed Hikes in 2023

Americans Give Up on Inflation Remaining Tame

If Inflation Returns, Bond’s Diversification Power May Disappear

Essentially Nothing. That’s How Much Bonds May Return Over Next Five Years

It’s Getting Harder to Fund Retirement Using Bonds

This commentary is written by Horizon Investments’ asset management team. For additional commentary and media interviews, contact Chief Investment Officer Scott Ladner at 704-919-3602 or sladner@horizoninvestments.com.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. It is not possible to invest directly in an index.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2022 Horizon Investments LLC