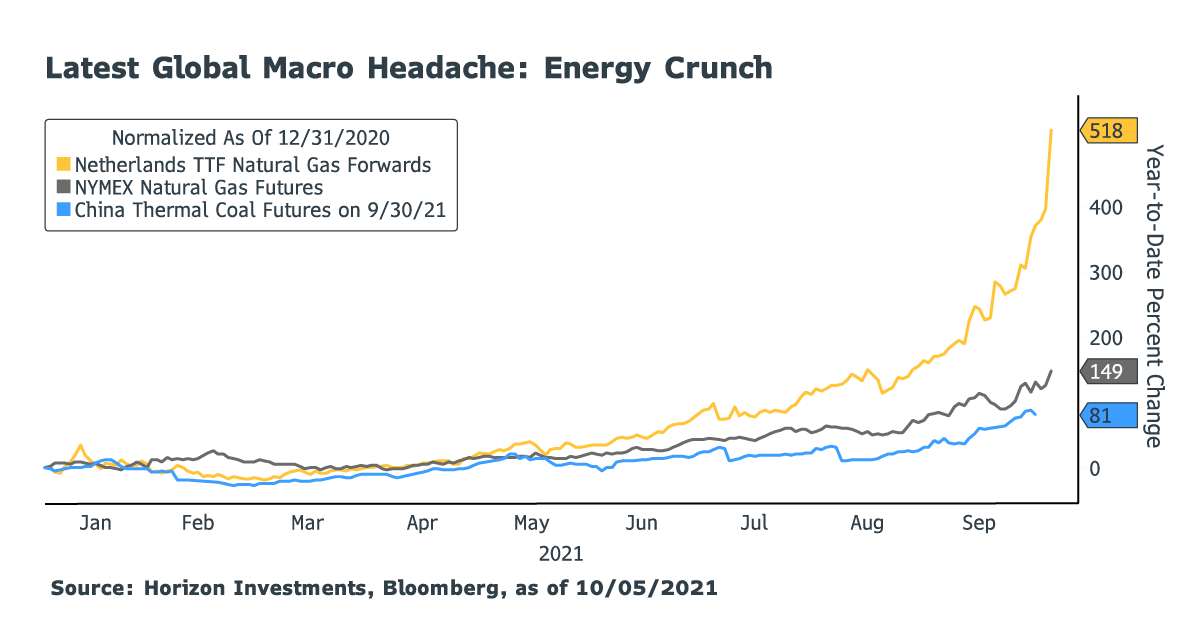

The newest twist on snarled supply chains and inflation? A global energy crunch.

Intense competition is causing soaring prices for limited inventories of natural gas, oil, and coal as green energy policies reduce reliance on fossil fuels, while the fickle weather reduces renewable energy output worldwide. The unexpected pop in prices may hit global GDP growth and potentially sustain a higher rate of inflation, pressuring central bankers around the world to raise interest rates.

The combination of soaring prices, inflation pressures, and the hit to economic growth has some people raising the specter of a replay of the 1970’s stagflationary environment, when there was a combination of slow GDP growth and sticky inflation.

Many factors are hitting at once to cause the parabolic move in some energy prices, including lower-than-normal stockpiles of fuels, a drop in renewable energy output, Russian pipelines delivering less gas than what’s needed in Europe, and a drought in China that’s hurting hydro-electric output as electricity demand soared with a reopening economy.

Lastly, OPEC decided this week to stick with its measured boost of crude oil output, dashing hopes it would pump more.

The macroeconomic implications from the current energy spike could be wide-ranging:

- GDP growth in Europe and China may be reduced as corporate and consumer spending is re-routed to utility bills rather than consumption of goods and services

- European food costs may rise as energy-intensive Dutch greenhouses, which supply many fresh foods across the continent, reduce production

- Supply chain bottlenecks may not get resolved as Chinese factories reduce output as part of government orders to reduce power consumption

- Corporate profit forecasts may need to be adjusted as energy prices squeeze margins and sales tumble as customers divert money to paying their utility bills

However, the comparison to the1970s environment ignores crucial differences today compared to 50 years ago:

- The energy intensity of GDP is half of what it was in the 1970s

- It currently takes 0.43 barrel of oil to produce $1,000 of global GDP versus nearly 1.0 barrel of oil to produce the same amount of GDP in 1973, according to Columbia University’s Center on Global Energy Policy1

- OPEC remains a powerful force in crude oil markets with 40% market share, down from the 1970s when it held 56%2 of the market and instituted an embargo on sales to the U.S. during a military conflict

- U.S. frackers (a technological breakthrough that wasn’t available in the 1970s) could rapidly increase production, though they currently have been slow to do so amid investor demand for fiscal discipline

- The U.S. is now an exporter of oil versus being a major importer 50 years ago

Horizon Investments continues to believe that the supply/demand mismatches that are leading to higher prices in many products will be ironed out. And when that occurs, inflationary pressures could ease. We saw this with car and truck rental prices which sank 7% month on month in the August Consumer Price Index (CPI) report as more rentals were available. Compare that to April’s CPI report when rental prices soared by 15% as demand outstripped the number of available vehicles for rent.

(Read Horizon’s Redefining Risk paper to understand our goals-based investing philosophy)

That said, Horizon’s goals-based investment management process is built to be flexible and dynamic – rather than dogmatic. As market leadership and macroeconomic conditions evolve, our Gain stage investing strategies aim to adapt to those changes to help deliver the risk-adjusted returns investors are seeking to reach their long-term financial goals. That same flexibility is also how Horizon constructs its strategies for the Protect and Spend stages.

Further reading:

Are Glide Path Strategies Still a Good Option for Retirement?

Biggest Retirement Fear? Outliving My Money

Essentially Nothing. That’s How Much Bonds May Return Over Next Five Years

It’s Getting Harder to Fund Retirement Using Bonds

Junk-Bond Yields Don’t Provide Much of a Cushion Against Inflation

If Inflation Returns, Bond’s Diversification Power May DisappearAbnormally Low Interest Rates Remain Even If Fed Raises Hikes in 2023

1 Columbia Univ. Center for Energy Policy, “Oil Intensity: The Curiously Steady Decline of Oil in GDP,” Sept. 9, 2021

2 Sources: International Energy Administration and University of Calgary

This commentary is written by Horizon Investments’ asset management team. For additional commentary and media interviews, contact Chief Investment Officer Scott Ladner at 704-919-3602 or sladner@horizoninvestments.com.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. It is not possible to invest directly in an index.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

The Real Spend® retirement income strategy is NOT A GUARANTEE against market loss and there is no guarantee that the Real Spend® strategy chosen by an investor will lead to successful investment outcomes for part of, or for the entirety of an investor’s retirement. This strategy is not an insurance product with payments guaranteed. It is a strategy that invests in marketable securities, any of which will fluctuate in value. Before investing, consider the investment objectives, risks, charges, and expenses of the strategy. Keep in mind investing involves risk. The value of an investment will fluctuate over time and will gain or lose money.

RiskAssist® is NOT A GUARANTEE against loss or declines in the value of a portfolio; it is an investment strategy that supplements a more traditional strategy by periodically modifying exposure to fixed income securities based on Horizon’s view of market conditions. While Risk Assist was designed with the goal of limiting drawdown, Horizon is not able to predict all market conditions and ensure that Risk Assist will always limit drawdown as designed.

Accounts with Risk Assist® are not fully protected against all loss. Furthermore, when Risk Assist® is deployed (whether partially or entirely) to mitigate risk for an account, the account will not be fully invested in its original strategy, and accordingly during periods of strong market growth the account may underperform accounts that do not have the Risk Assist® feature. Clients may lose money.

Horizon Investments makes no predictions, representations, or warranties herein as to the future performance of any portfolio. Past performance is never a guarantee of future results. There may be economic times where all investments are unfavorable and depreciate in value.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2021 Horizon Investments LLC