Junk-bonds’ power to beat inflation is fading — the gap between them has shrunk to a three-decade low of just 0.75%.

Yet another setback for retirees who view traditional fixed-income investments as a secure way to fund a long retirement.

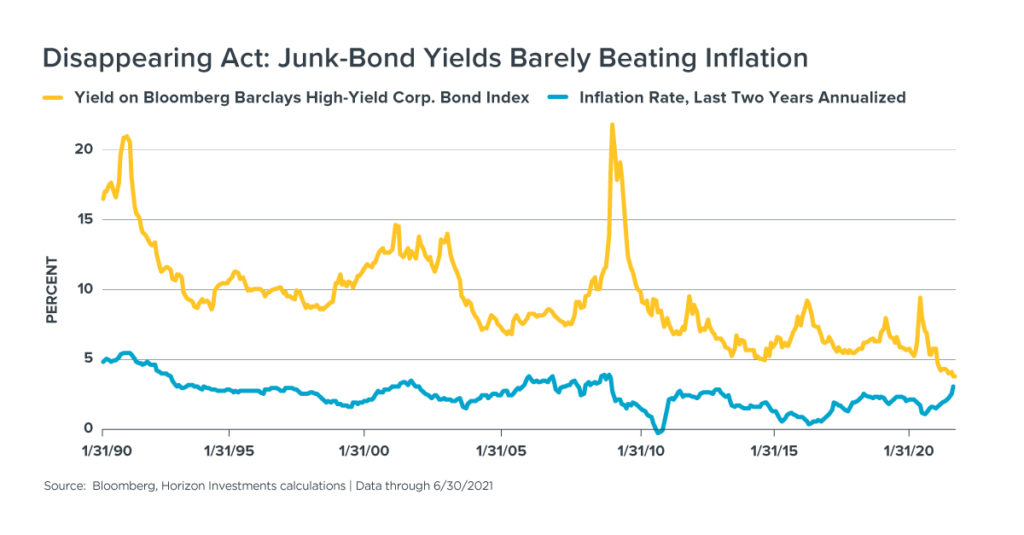

The gap between yields on junk bonds and the annualized two-year rate of inflation is the smallest level ever — just 0.75% — in data going back three decades. (N.B.: Horizon is using a two-year inflation rate to smooth out the retreats and rallies that occur during recessions and recoveries.)

As the chart below shows, the more significant change in the last year is new lows for yields on junk-bonds, rather than a paradigm shift for inflation, despite recent high readings for the Consumer Price Index as the economy reopens.

What’s disconcerting for retirees, in our view, is that the yield on junk bonds has dropped under 5%. A yield below that level was the rare exception over the last three decades. However, since November 2020, yields are holding below 5%, and recently breached 4%.

The practical effect on a retiree is that the riskiest sub-set of bonds — following in the footsteps of Treasuries and investment-grade corporate bonds — are no longer providing a comfortable cushion over the medium-term rate of inflation, which could impair their spending plans.

Why are yields dropping? We believe it’s because of the reach-for-yield by fixed-income investors around the world, who are running out of places to find positive, inflation-adjusted returns. That behavior is being spurred by the Federal Reserve’s zero interest rate policy and the low-rate policies of the other major central banks.

Further compression of bond-market yields likely means a further depression of inflation-adjusted, returns.

(See Horizon’s Q1 Focus feature article, “Crushed by Zero,” about the difficulties and potential solutions for investing in a zero-interest rate world.)

Horizon believes that financial advisors who embrace goals-based financial planning can assist retirees in making decisions that can reduce longevity and short-fall risks — risks that could increase if a retiree’s portfolio is too reliant on fixed-income. Our research paper on retirement investing and risks details our view of the issue.

As goals-based investors, we believe that bond-market alternatives, a larger tilt towards equities, and incorporating a risk-mitigation overlay are what retirees and their advisors may want to consider to help ensure a nest egg remains well-funded during what could be a long retirement. See our Real Spend® web page for details about Horizon’s goals-based distribution strategy, which is aimed at increasing the probability that a client’s money will be there for them during a long retirement.

Further reading:

Q2 Focus: A New Pattern of Life

Abnormally Low Rates Remain, Even If Fed Raises Rates in 2023

It’s Getting Harder to Fund Retirement Using Bonds

If Inflation Returns, Bond’s Diversification Power May Disappear

Essentially Nothing. That’s How Much Bonds May Return Over Next Five Years

Retirement Planning: Are Investors Underestimating Longevity Risk?

Home Prices to the Moon? Americans Say `No Thanks’

Pandemic Economic Weirdness Captured in One Chart

To download a copy of this commentary, click the button below.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. It is not possible to invest directly in an index.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

The Real Spend® retirement income strategy is NOT A GUARANTEE against market loss and there is no guarantee that the Real Spend® strategy chosen by an investor will lead to successful investment outcomes for part of, or for the entirety of an investor’s retirement. This strategy is not an insurance product with payments guaranteed. It is a strategy that invests in marketable securities, any of which will fluctuate in value. Before investing, consider the investment objectives, risks, charges, and expenses of the strategy. Keep in mind investing involves risk. The value of an investment will fluctuate over time and will gain or lose money.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments, Real Spend and the Horizon H are registered trademarks of Horizon Investments, LLC

©2021 Horizon Investments LLC