Moving On Up

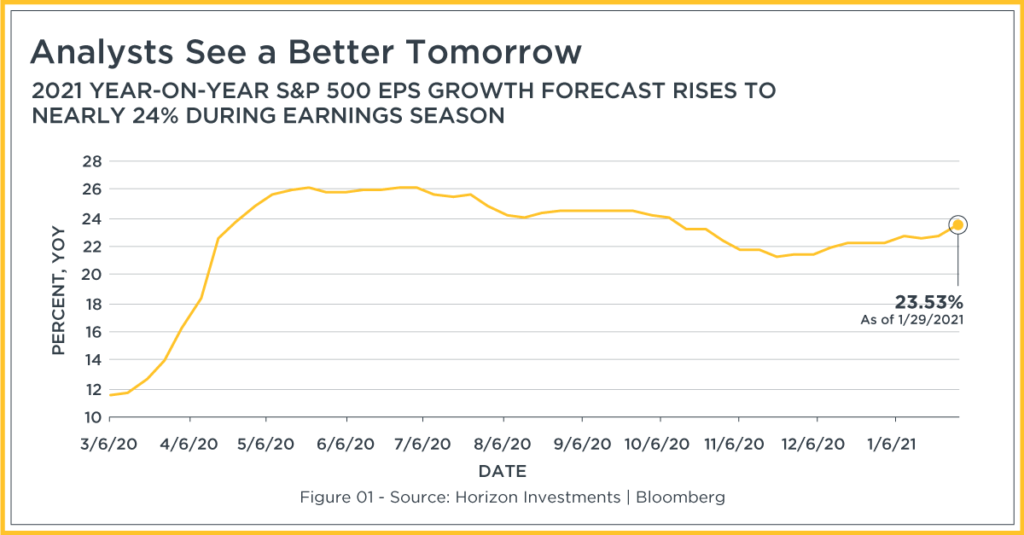

A record high for stocks…again. Earnings get much of the credit for the latest move. More than half of the S&P 500’s companies have reported earnings, with about 80% of them beating Wall Street’s estimates. Investors are more interested in what the future holds and good news can be found there, too. Wall Street analysts are raising their company forecasts, boosting the S&P 500’s 2021 year-on-year earnings growth forecast to nearly 24%, helping explain the persistent bid for equities.

Bond Market Punching Bag

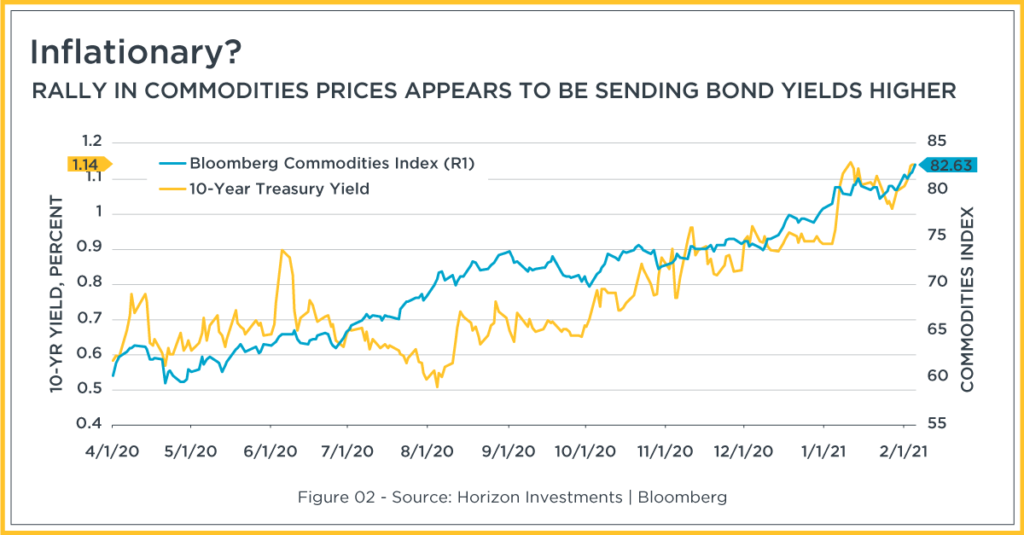

Treasury bonds are having a rough week as the news from all sides argues for higher yields. The biggest hit is the comeback in inflation, but only in terms of more people discussing it rather than any data showing a problem.

The eye-catching inflation news is commodities, especially oil. Supplies are in retreat and a rebounding world economy is consuming more, so there’s a resurgence in prices from crude to corn to copper. Their breakouts to new rebound highs is the spark for the feeling that inflation is in the pipeline. That’s generally bad news for fixed-income markets, especially since the Federal Reserve is promising not to react to rising prices.

Wall Street is also latching onto a nearly 10-year high in January for the prices manufacturers are paying for their supplies. Those data have a reasonably good historical record of telegraphing inflation’s direction.

Then there’s the not-too-hot, not-too-cold labor market. January job growth was, at best, modest. And that gives Congress and the White House an opening to push through trillions more in stimulus spending to boost GDP growth. However, there was an unexpectedly large drop in continuing claims for unemployment benefits in the latest report, suggesting hiring is picking up before the new stimulus hits.

For all of the inflationary signals, traders in the fixed-income markets are taking it slow in ratcheting up future inflation expectations. After all, service sector inflation remains tame – and that’s the largest part of the U.S. economy. And inflation hasn’t been a problem for years, despite growing employment and GDP, as the expanding use of technology makes work more productive, offsetting rising prices elsewhere.

Horizon Investments’ view is that the danger of a spike in inflation is low, but it is something goals-based investors should be aware of because even a modest increase in the cost of living could severely curtail the income that comes from bonds over the medium term.

Game Stopped

The GameStop mania may be fading as quickly as it appeared, sending shares of the company down about 70% this week (as of 10 a.m. Friday morning). Horizon noted last week that the equity market was acting strangely as traders tried to process the eruption of such an unpredictable event by broadly reducing stock market exposures. But we also noted that stocks weren’t infecting other asset classes. With the clearing of the GameStop fog this week, it’s the positive macro backdrop that’s taking center stage again in dictating where market returns are headed.

What to Watch

- Inflation: The Consumer Price Index is reported Wednesday with economists expecting 1.5% year-on-year growth. An inline report may disappoint bearish traders, sending yields lower.

- Federal Reserve Chairman Powell speaks: He’s highly likely to keep an easy monetary policy stance.

- Earnings: About 29% of the S&P 500 reports, including Walt Disney, Cisco, Coca-Cola & GM

- Stimulus plans: President Biden and the Democrats continue to hammer out the details of a plan that could pass along partisan lines.

Related stories:

If Inflation Returns, Bond’s Diversification Power May Disappear

Essentially Nothing. That’s How Much Bonds May Return Over Next Five Years

Only Two Words Matter to Markets: Stimulus Spending

Bond Market Bears Growling as 10-Year Yield Breaks Through Important 1% Level

PIIGS Fly and Other Stories of Investors Reaching for Risky Bets

Momentum’s No Longer the Stock Market King, Vaccine Will Raise New Leadership

It’s Getting Harder to Fund Retirement Using Bonds

7.9 Trillion Reasons Not to Fight the Fed, ECB, BOJ or BOE

This commentary is written by Horizon Investments’ asset management team. For additional commentary and media interviews, contact Chief Investment Officer Scott Ladner at 704-919-3602 or sladner@horizoninvestments.com.

To download a copy of this commentary and the chart of the week, click the button below.

To discuss how we can empower you please contact us at 866.371.2399 ext. 202 or info@horizoninvestments.com.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. It is not possible to invest directly in an index.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2021 Horizon Investments LLC

Insights

High & Mighty Stocks; Feeling Inflationary?; Game Stopped

Share:

Moving On Up

A record high for stocks…again. Earnings get much of the credit for the latest move. More than half of the S&P 500’s companies have reported earnings, with about 80% of them beating Wall Street’s estimates. Investors are more interested in what the future holds and good news can be found there, too. Wall Street analysts are raising their company forecasts, boosting the S&P 500’s 2021 year-on-year earnings growth forecast to nearly 24%, helping explain the persistent bid for equities.

Bond Market Punching Bag

Treasury bonds are having a rough week as the news from all sides argues for higher yields. The biggest hit is the comeback in inflation, but only in terms of more people discussing it rather than any data showing a problem.

The eye-catching inflation news is commodities, especially oil. Supplies are in retreat and a rebounding world economy is consuming more, so there’s a resurgence in prices from crude to corn to copper. Their breakouts to new rebound highs is the spark for the feeling that inflation is in the pipeline. That’s generally bad news for fixed-income markets, especially since the Federal Reserve is promising not to react to rising prices.

Wall Street is also latching onto a nearly 10-year high in January for the prices manufacturers are paying for their supplies. Those data have a reasonably good historical record of telegraphing inflation’s direction.

Then there’s the not-too-hot, not-too-cold labor market. January job growth was, at best, modest. And that gives Congress and the White House an opening to push through trillions more in stimulus spending to boost GDP growth. However, there was an unexpectedly large drop in continuing claims for unemployment benefits in the latest report, suggesting hiring is picking up before the new stimulus hits.

For all of the inflationary signals, traders in the fixed-income markets are taking it slow in ratcheting up future inflation expectations. After all, service sector inflation remains tame – and that’s the largest part of the U.S. economy. And inflation hasn’t been a problem for years, despite growing employment and GDP, as the expanding use of technology makes work more productive, offsetting rising prices elsewhere.

Horizon Investments’ view is that the danger of a spike in inflation is low, but it is something goals-based investors should be aware of because even a modest increase in the cost of living could severely curtail the income that comes from bonds over the medium term.

Game Stopped

The GameStop mania may be fading as quickly as it appeared, sending shares of the company down about 70% this week (as of 10 a.m. Friday morning). Horizon noted last week that the equity market was acting strangely as traders tried to process the eruption of such an unpredictable event by broadly reducing stock market exposures. But we also noted that stocks weren’t infecting other asset classes. With the clearing of the GameStop fog this week, it’s the positive macro backdrop that’s taking center stage again in dictating where market returns are headed.

What to Watch

Related stories:

If Inflation Returns, Bond’s Diversification Power May Disappear

Essentially Nothing. That’s How Much Bonds May Return Over Next Five Years

Only Two Words Matter to Markets: Stimulus Spending

Bond Market Bears Growling as 10-Year Yield Breaks Through Important 1% Level

PIIGS Fly and Other Stories of Investors Reaching for Risky Bets

Momentum’s No Longer the Stock Market King, Vaccine Will Raise New Leadership

It’s Getting Harder to Fund Retirement Using Bonds

7.9 Trillion Reasons Not to Fight the Fed, ECB, BOJ or BOE

This commentary is written by Horizon Investments’ asset management team. For additional commentary and media interviews, contact Chief Investment Officer Scott Ladner at 704-919-3602 or sladner@horizoninvestments.com.

To download a copy of this commentary and the chart of the week, click the button below.

To discuss how we can empower you please contact us at 866.371.2399 ext. 202 or info@horizoninvestments.com.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. It is not possible to invest directly in an index.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2021 Horizon Investments LLC

Follow us on: