2022 is starting off on the wrong foot for anyone who was expecting oil prices to come down and bring some relief to America’s inflation statistics. West Texas Intermediate crude reached $92 per barrel on February 4, reflecting a $15 rally since the start of the year.

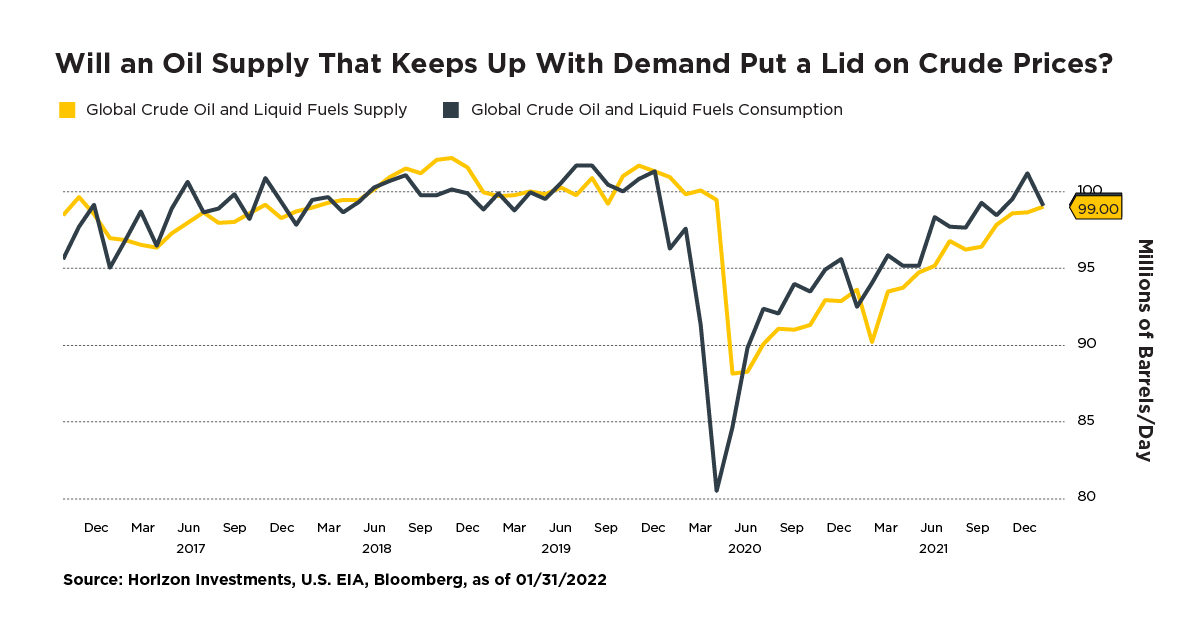

On the other hand, you can’t blame oil’s jump on a mismatch of supply and demand. The two were essentially in balance in January. Worldwide oil use outpaced production by just 30,000 barrels per day last month, according to the U.S. Energy Information Administration’s (EIA) report this week.[1]

January’s figures close the deficit of 2.6 million barrels per day that was recorded in December. Leaving aside the possible Russian invasion of Ukraine, the supply/demand relationship will likely be a key determinant of whether U.S. crude oil prices can reach $100 per barrel in the near future.

Similar to many other parts of the economy, from cars to appliances, crude oil’s recent rally to $92/barrel was driven by a problem on the supply side. Oil output had not been bouncing back fast enough to meet rising demand as more countries lifted pandemic economic restrictions.

But January’s EIA data may begin to flip the narrative. The EIA is forecasting that from March onward, production will be larger than demand, which will slowly rebuild depleted inventories. And as inventories rise, that opens the door to a stabilization in crude prices, which could have a positive knock-on effect on inflation.

Energy is an important component in the Consumer Price Index (CPI), the inflation report that everyone has their eyes on. Energy’s weight in the CPI is currently about 7%. Combine energy with housing (which we wrote about in last week’s Big Number: Disappearing Foreclosures), and together those two items account for about 40% of CPI. We need to keep a close eye on both of them to see if the pace of inflation does retreat this year as predicted by many economists (see our Q4 Focus for details).

From our point of view, the expected return to balance in the oil market exemplifies why we believe that there’s little reason for goals-based investors to worry that the current spurt of inflation could scramble their long-term financial objectives. Historically, high oil prices drew more barrels onto the global market. As supplies grew, oil prices tended to respond by stabilizing or tumbling.

Expectations that the oil market will remain in balance means that there’s still a reasonable probability that the energy inflation we’re now seeing ends up being a blip over the long-term.

Different Recommendations for Different Stages

The design of the goals-based framework is that it is able to flex and adapt as either the macro situation or a client’s personal situation changes due to the impact of inflation – or other factors – in their stage of the investor journey.

For GAIN stage investors, time is on your side when it comes to inflation. An appropriate asset allocation based on your risk tolerance can allow you to weather short-term volatility in pursuit of your long-term accumulation goals.

For PROTECT stage investors, the shorter time horizon to your goal requires heightened sensitivity to market pullbacks and inflation. A well-formulated plan that consists of multiple risk mitigation strategies may help take some of the emotion out of your short-term portfolio performance and can help lead to better outcomes.

And for SPEND stage investors, today’s high inflation and low bond yields are a difficult investment backdrop. A systematic total-return strategy, tilted toward equity markets and equipped with a dynamic, risk-management process, may help meet your spending needs in the years to come.

Further reading:

Q4 Focus Magazine: The Good, The Bad and The Ugly of Inflation

2022 Outlook: The Next Unprecedented Year

Disappearing Foreclosures Add to Housing Inflation Pressures

Is Inflation Pressure Easing? Factory Input Costs Tumble Again

If Inflation Returns, Bond’s Diversification Power May Disappear

Essentially Nothing. That’s How Much Bonds May Return Over Next Five Years

It’s Getting Harder to Fund Retirement Using Bonds

The Biggest Retirement Fear: Outliving My Money

Many GenXers Agree: It’ll Take a Miracle to Have a Secure Retirement

This commentary is written by Horizon Investments’ asset management team. For additional commentary and media interviews, contact Chief Investment Officer Scott Ladner at 704-919-3602 or sladner@horizoninvestments.com.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. It is not possible to invest directly in an index.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times where all investments are unfavorable and depreciate in value. Clients may lose money.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments, Risk Assist and the Horizon H are registered trademarks of Horizon Investments, LLC

©2022 Horizon Investments LLC